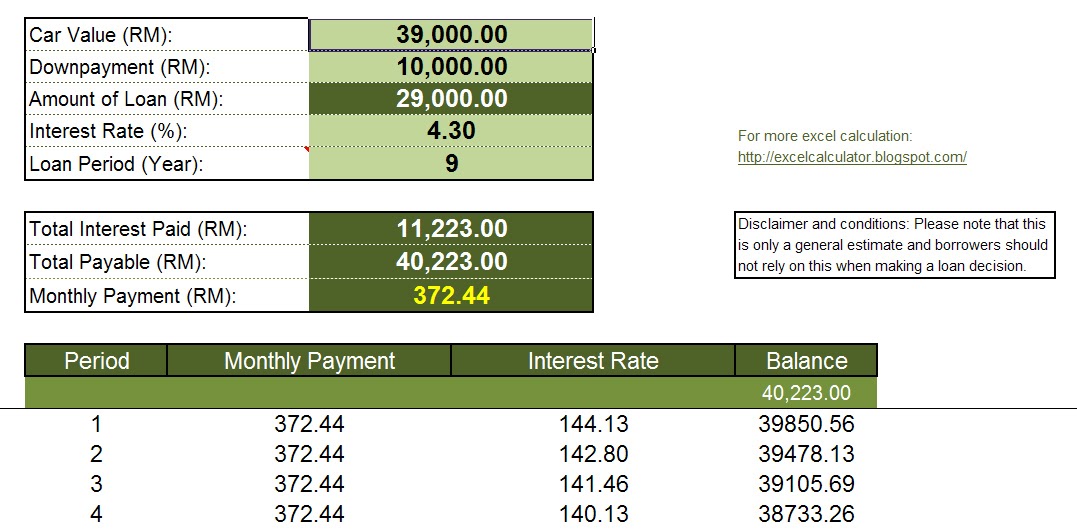

Monthly Payment The amount to be paid toward the loan at each monthly payment due date. Number of Months The number of payments required to repay the loan.

Interest Rate The annual nominal interest rate, or stated rate of the loan.

Loan Amount The original principal on a new loan or principal remaining on an existing loan.

Truck finance calculator plus#

You can also create and print a loan amortization schedule to see how your monthly payment will pay-off the loan principal plus interest over the course of the loan. Find your ideal payment by changing loan amount, interest rate and term and seeing the effect on payment amount. You can easily compare an 84 month auto loan to a 60 month auto loan by using our 60 month auto loan calculator.Use this loan calculator to determine your monthly payment, interest rate, number of months or principal amount on a loan. This means you’ll need to plan for additional car repairs during the last few years you’re paying off the car. While an 84 month car loan may give you a lower monthly payment, most warranties expire around the 3-5 year mark. Therefore, an 84 month auto loan or a 60 month auto loan could mean the difference between getting “underwater” with your car loan (ie. New cars rapidly depreciate in value as soon as you drive them off the lot. A 60 month auto loan almost always offers lower interest rates than a 84 month auto loan, meaning more money in your pocket (instead of the lenders). Generally, the shorter the auto loan term, the lower your offered interest rate will be. Additionally, a new car warranty will expire in 3-5 years, leaving you with several years of car maintenance repairs as well as your monthly auto loan payment. 72 Month Auto Loanīoth the 84 month auto loan and the 72 month auto loan are considered long-term loans, but the 84 month loan will likely have a higher interest rate.īecause both of these loans are long-term, your car will depreciate and you may end up owing more than the car is worth. However, you should weigh the pros and cons to determine whether an 84-month auto loan is the right choice for you and your family.Ĩ4 Month Auto Loan vs. Advantages and Disadvantages of a 7-Year Car LoanĪ long-term auto loan can make purchasing an expensive car seem more affordable. You can find your amortization schedule for your 84 month auto loan after running your calculation. If you took out a $55,000 new auto loan for an 84 month term at 4.5% interest, your monthly payment would be $764.51.Īlthough your monthly payments won't change during the term of your loan, the amount applied to principal versus interest will vary based on the amortization schedule. Here's how this will look when you enter the data into our 84 month loan calculator: Example of an 84 Month Car Loanįor example, if you plan to borrow $55,000 for a term of 84 months at an annual interest rate of 4.5%, then you will enter: The 84 month auto loan calculator will work the same to calculate the variances.

Truck finance calculator free#

If you're still considering a variety of auto loan terms or prices, feel free to play around with several of these numbers.

Truck finance calculator full#

This car loan calculator determines your monthly payment and displays a full repayment schedule based on your: How the 84 Month Car Loan Calculator Works

0 kommentar(er)

0 kommentar(er)